In this blog post, we will discuss the four most common business structures: sole proprietorship, partnership, limited liability company (LLC), and corporation.

Sole Proprietorship

A sole proprietorship is the simplest business structure, where a single individual owns and operates the business. The owner has full control over the business and assumes all liability for its debts and legal obligations. From a tax perspective, the owner reports business income and expenses on their personal tax return. This structure offers ease of setup and low regulatory requirements.

Partnership

A partnership is a business structure in which two or more individuals share ownership and management responsibilities. Partners contribute capital, expertise, and effort to the business. There are two main types of partnerships: general partnerships, where partners share equal responsibility and liability, and limited partnerships, where some partners have limited liability. Partnerships file a separate tax return, but the profits or losses flow through to the partners’ individual tax returns.

Limited Liability Company (LLC)

An LLC is a popular business structure that combines the liability protection of a corporation with the flexibility of a partnership. Therefore, LLC owners, called members, have limited personal liability for the company’s debts and obligations. LLCs offer flexibility in management structure and can choose to be taxed as a partnership, sole proprietorship, or corporation. The tax treatment of an LLC depends on the number of members and the elections made.

Corporation

A corporation is a separate legal entity that is owned by shareholders. It provides the strongest liability protection to its owners, known as shareholders, who are generally not personally responsible for the company’s debts and legal liabilities. However, corporations have a more complex structure, including a board of directors, officers, and shareholders. From a tax perspective, corporations are subject to double taxation, where the corporation pays taxes on its profits, and shareholders are taxed on dividends received.

Final Thoughts

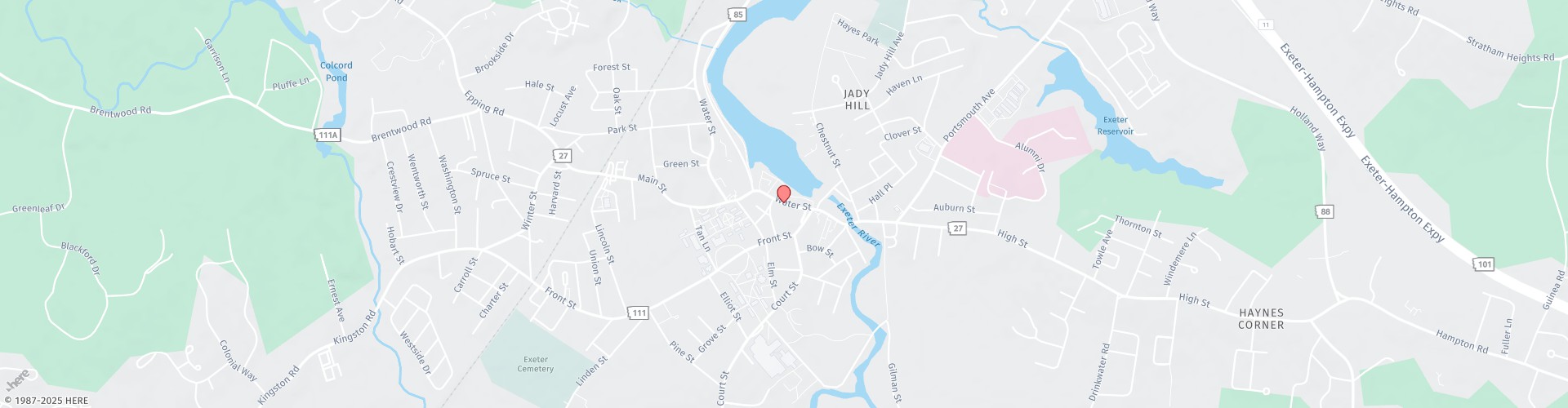

Selecting the right business structure is a crucial step in setting up your business for success. It is recommended to consult with legal and tax professionals to assess your specific needs and goals. Liguori Accounting helps business owners evaluate the benefits of converting to different business structures. With our help, owners feel they can make an informed decision that aligns with their goals and objectives. Reach out to the team to start a conversation.This entry was posted in Tax and tagged business structure, small business. Bookmark the permalink.