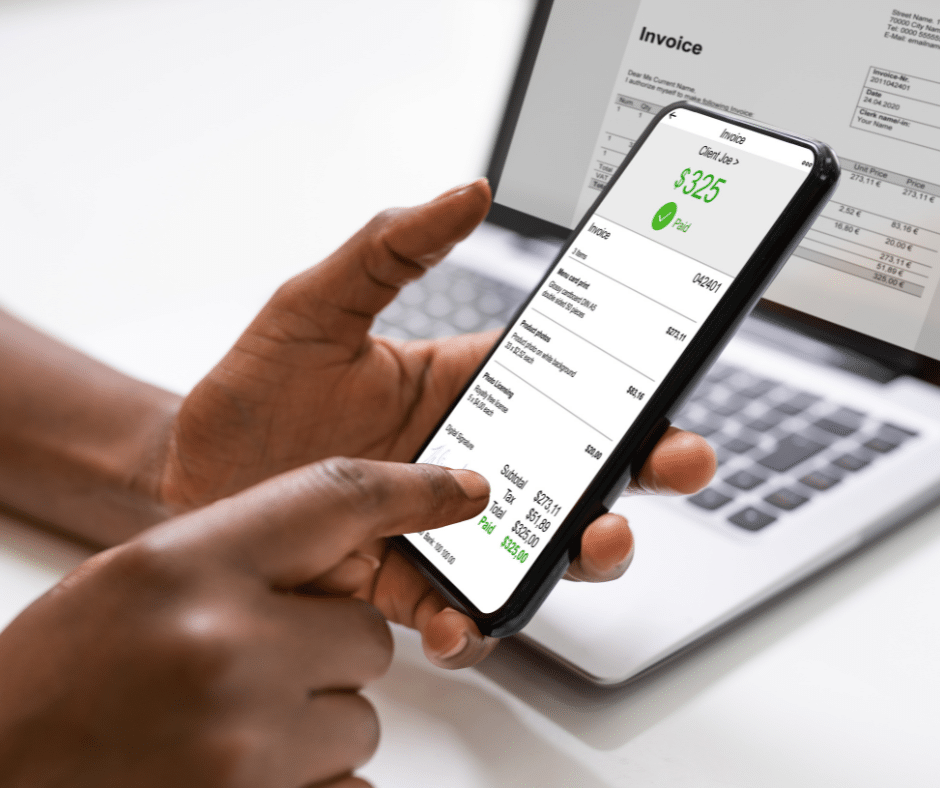

Considering Digital Receipts for Your Business

1. Digital receipts decrease costs Receipts eat into your profits. It costs money to buy the paper and the ink which is more than it costs to simply email receipts to clients. Your business saves money by not printing receipts for every customer. On a per-unit basis, receipts might not seem like a big cost. […]

Considering Digital Receipts for Your Business Read More »

Accounting/Bookkeeping