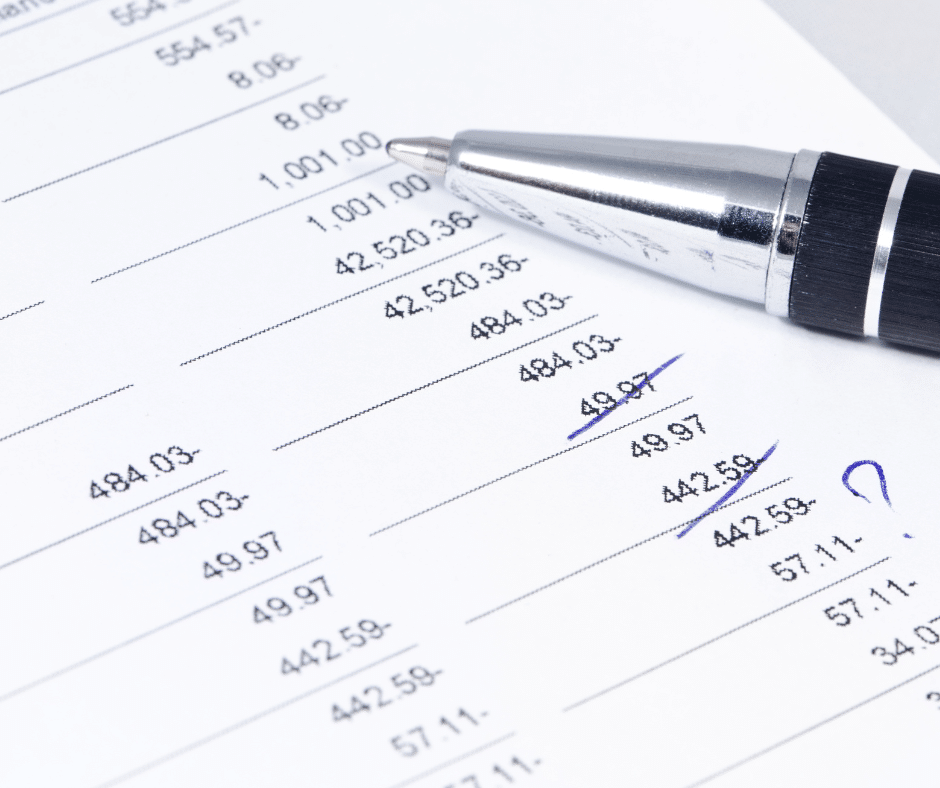

Identifying Your Financial Health: A Guide for Medical Spa Owners

Managing a successful medical spa requires more than just providing excellent services; it also involves keeping a close eye on your financial health. Ensuring your financials are in line with industry standards is key to achieving long-term profitability. In this guide, we’ll break down the essential financial metrics every medical spa owner should monitor. Key […]

Identifying Your Financial Health: A Guide for Medical Spa Owners Read More »

CFO Consulting